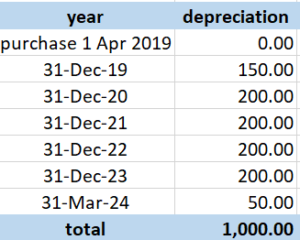

The average rate of depreciation in value of a laptop is 10% per annum. After three complete years its valuewas ksh 35,000. Determine its value at the start of the three-year period.(3marks) -

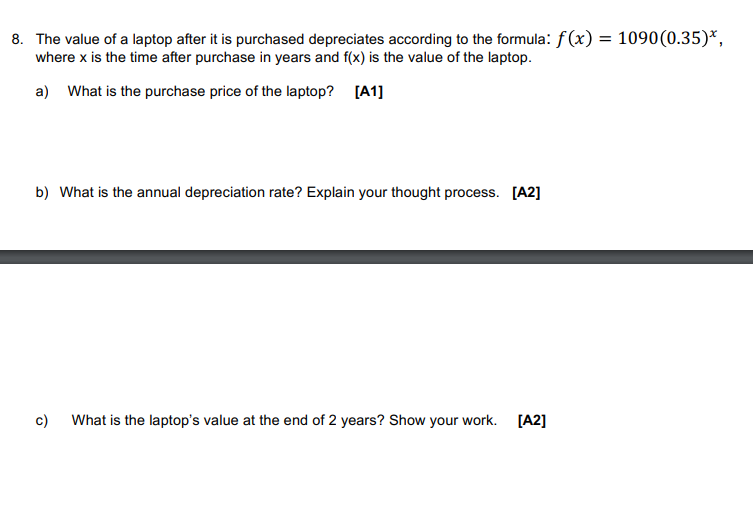

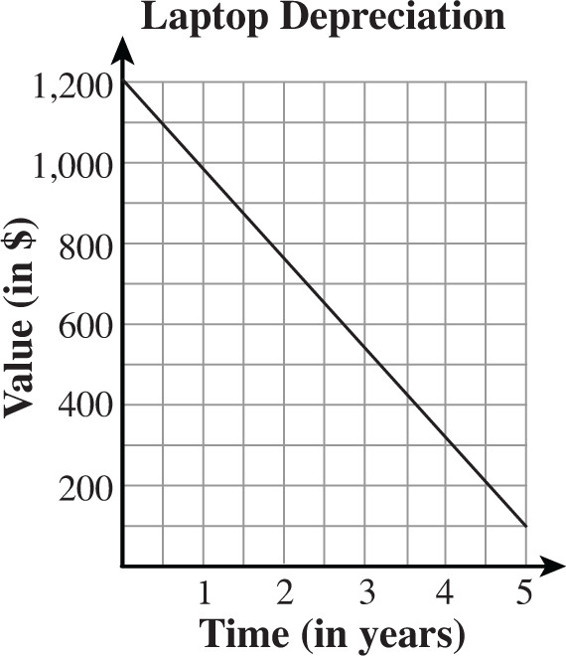

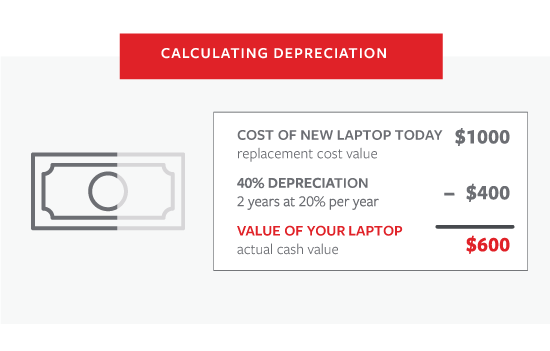

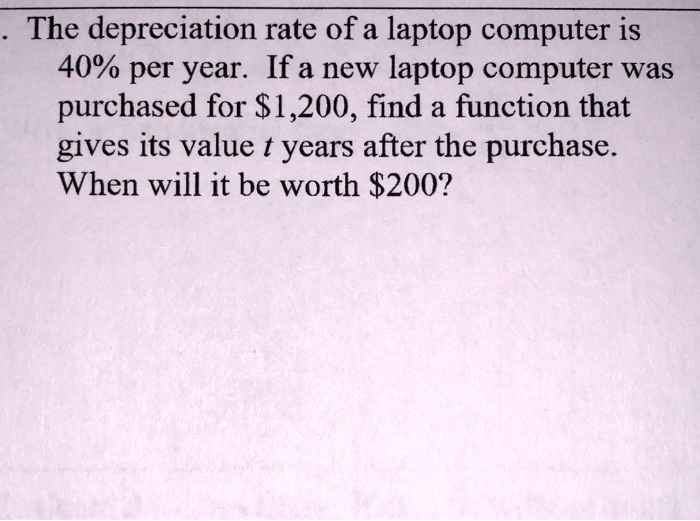

SOLVED: The depreciation rate of a laptop computer is 40% per year: If a new laptop computer was purchased for $1,200, find a function that gives its value t years after the

The average rate of depreciation in value of a laptop is 10% per annum. After three complete years its valuewas ksh 35,000. Determine its value at the start of the three-year period.(3marks) -