Buy Commercial's Income Tax Act - 10/edition, 2021 Book Online at Low Prices in India | Commercial's Income Tax Act - 10/edition, 2021 Reviews & Ratings - Amazon.in

FINANCE ACT, 2007 22 of 2007 [May 11, 2007] CHAPTER 1 :- PRELIMINARY CHAPTER 2 :- RATES OF INCOME-TAX CHAPTER 3 :- DIRECT TAXES

2009 No. 2859 INCOME TAX CAPITAL GAINS TAX CORPORATION TAX The Income Tax Act 2007 (Amendment) (No. 2) Order 2009

P.U.(A) 197/2007 Signed : 26 February 2007 Effective Date : 1 January 2008 INCOME TAX ACT 1967 AND PETROLEUM (INCOME TAX) ACT 19

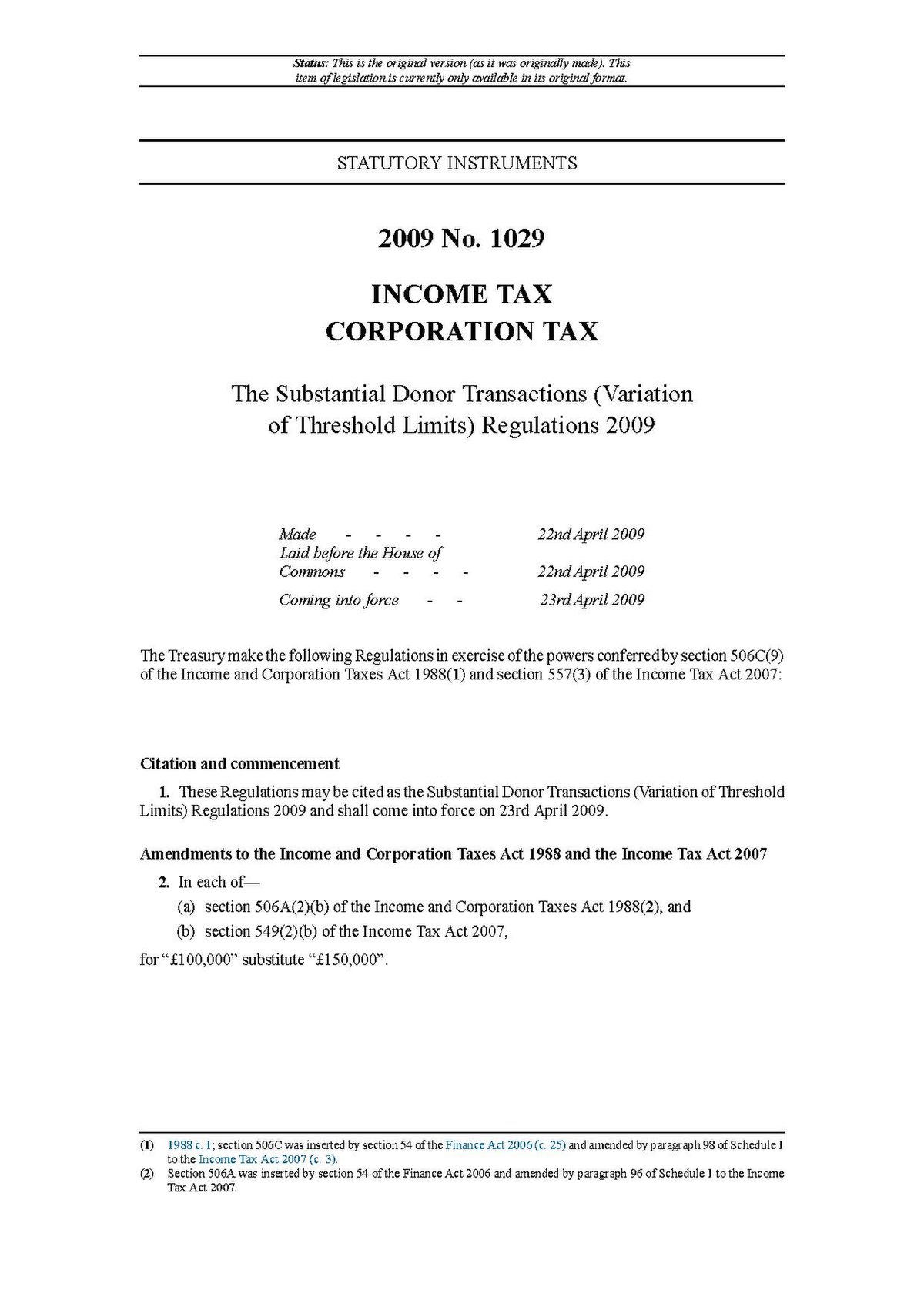

File:The Substantial Donor Transactions (Variation of Threshold Limits) Regulations 2009 (UKSI 2009-1029).pdf - Wikimedia Commons

MICHIGAN BUSINESS TAX ACT (EXCERPT) Act 36 of 2007 ***** 208.1103 THIS SECTION IS REPEALED BY ACT 90 OF 2019 EFFECTIVE FOR TAX Y

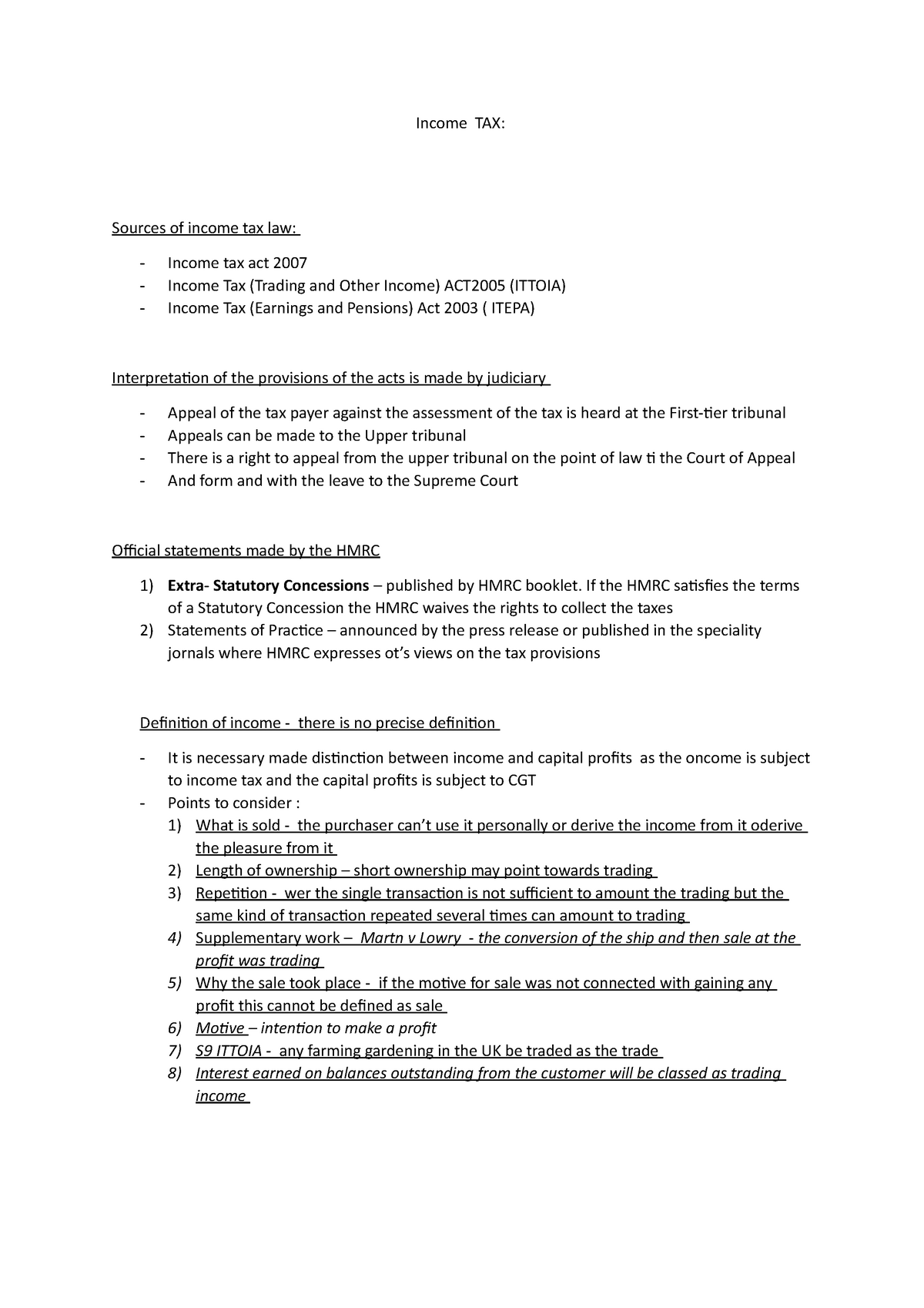

Income TAX notes - Income TAX: Sources of income tax law: - Income tax act 2007 Income Tax (Trading - Studocu

Consistency with the New Zealand Bill of Rights Act 1990: Taxation (Annual Rates for 2021-22, GST, and Remedial Matters) Bill P

File:The Substantial Donor Transactions (Variation of Threshold Limits) Regulations 2009 (UKSI 2009-1029 qp).pdf - Wikimedia Commons

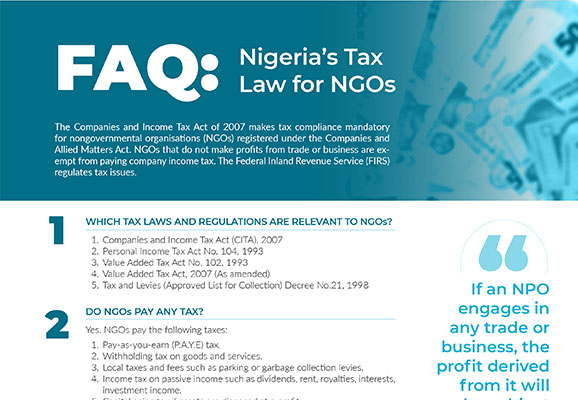

Tax Practise Questions with Answers - Business Law and Practise Tax Practice Questions with answers - Studocu

Lecture 2 - Income Tax - First Class Notes - Income Tax Introduction of Income Tax 1798 Pitt took an - Studocu

TO BE PUBLISHED IN THE GAZETTE OF INDIA (EXTRAORDINARY) PART II, SECTION 3, SUB-SECTION (ii)] GOVERNMENT OF INDIA MINISTRY OF