Prescribed time limit to treat payer as assessee-in-default is applicable even if the payee is NR: ITAT

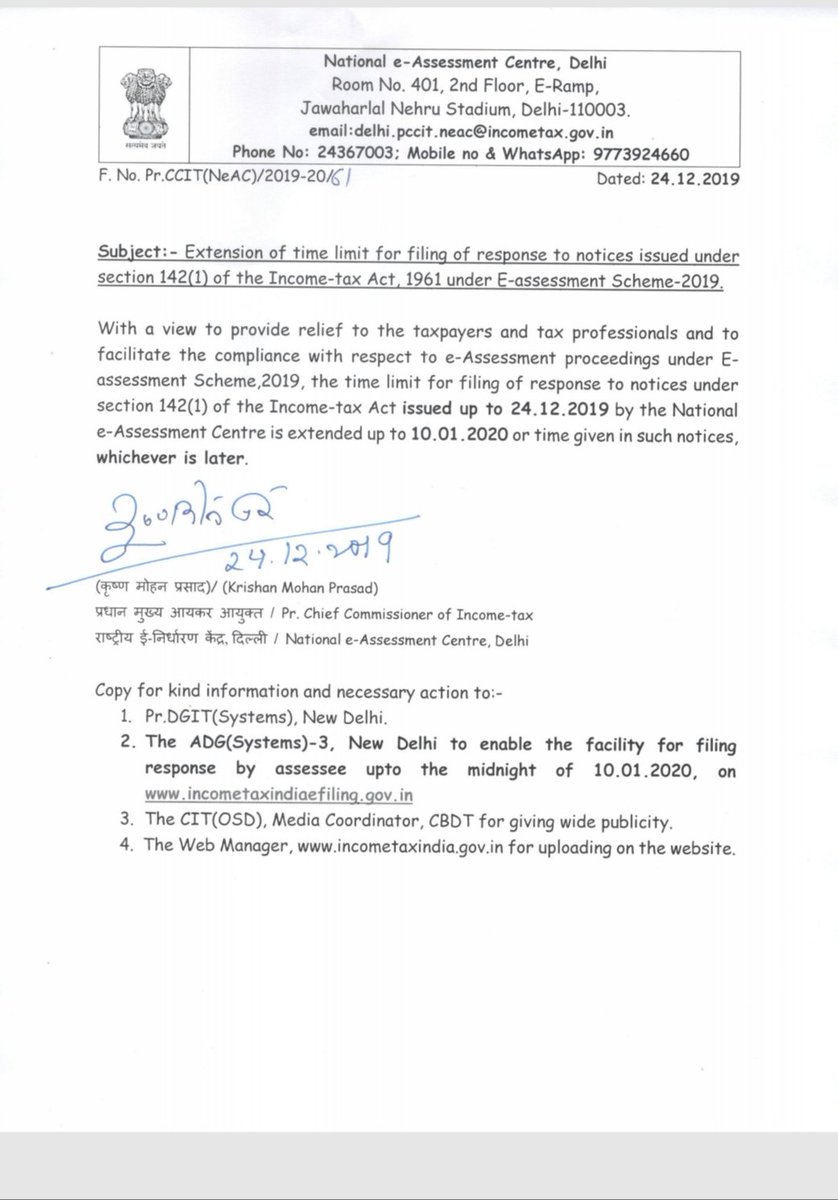

Extension of time limit for Compulsory Selection of returns for Complete Scrutiny during the Financial Year 2020-21 – CA Cult

Further extension of time limit for completion of assessment/ reassessment and imposition of penalty under the IT Act | A2Z Taxcorp LLP

CBIC extends time limit specified under Central Excise Act, Finance Act and Customs Act & Customs Tariff Act till Dec 31, 2020 | A2Z Taxcorp LLP

NExT exam: Govt invokes NMC Act provision, extends time limit for holding NExT exam for final year MBBS students till Sep 2024 - The Economic Times

Time Limit for completion of scrutiny assessment proceedings – Section 153 of the Income Tax Act: - Taxontips

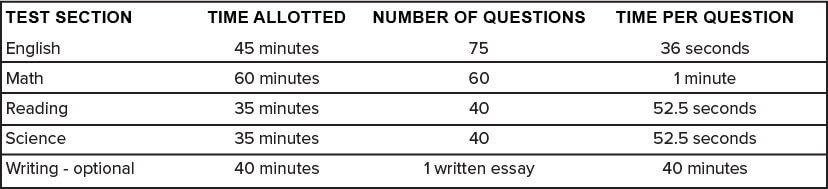

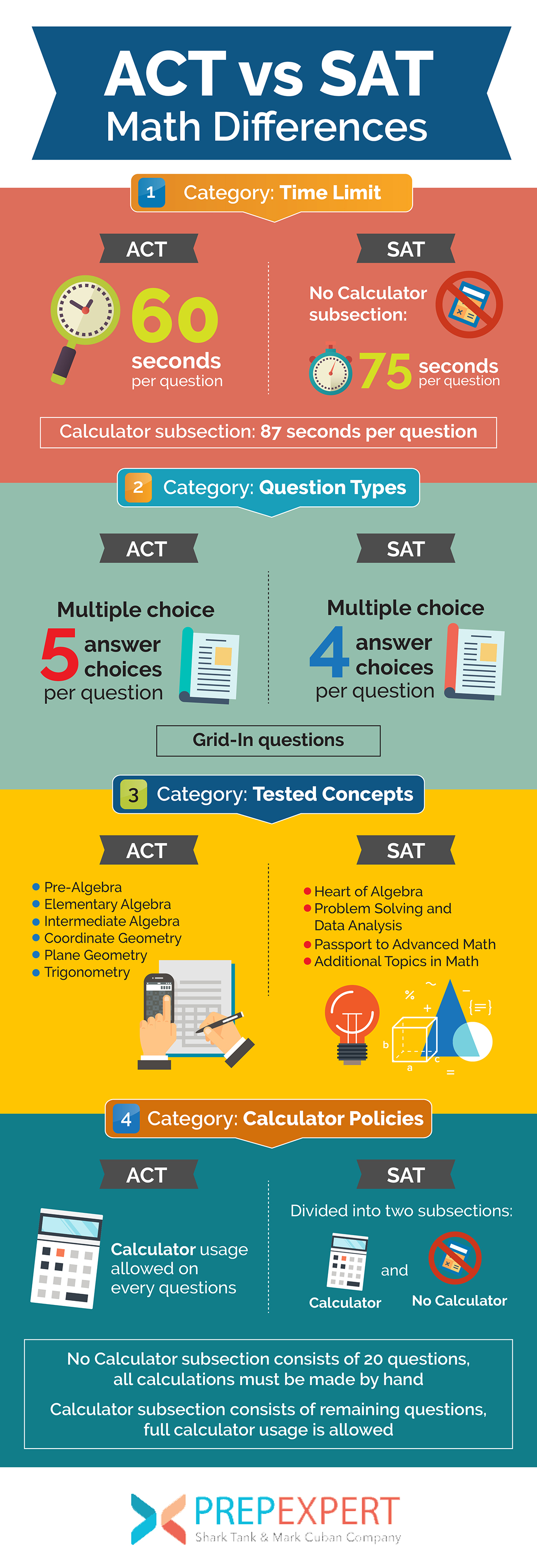

The ACT Writing section (aka the essay) is new for the 2015-2016 school year. | Brand College Consulting

Twin conditions of furnishing declaration within time limit "mandatory" for exemption relief under Section 10B (8) of IT Act: Supreme Court | SCC Blog

![Breaking] COVID-19: Govt extends Time Limit for Income Tax Assessments, Payments under Direct Tax Vivad se Vishwas Act Breaking] COVID-19: Govt extends Time Limit for Income Tax Assessments, Payments under Direct Tax Vivad se Vishwas Act](https://www.taxscan.in/wp-content/uploads/2021/04/COVID-19-Govt-extends-Time-Limit-Income-Tax-Assessments-covid-19-Payments-Direct-Tax-Vivad-se-Vishwas-Act-taxscan-open-graph.jpeg)

Breaking] COVID-19: Govt extends Time Limit for Income Tax Assessments, Payments under Direct Tax Vivad se Vishwas Act

Income Tax India on Twitter: "CBDT extends various limitation dates. Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021 issued. (1/4) https://t.co/ikC4AcQMpJ" / Twitter

![Time Limits under Right to Information Act 2005 [Right to Information Wiki] Time Limits under Right to Information Act 2005 [Right to Information Wiki]](https://righttoinformation.wiki/_media/guide/applicant/time_limit_rti.jpg?w=600&tok=868657)