Section 139(4) of Income tax act , Belated return, Belated return last date, belated return revision - YouTube

OPTOTAX - #optotaxitupdates #Extension of #DueDates under #IncomeTax ✓ Filing of Belated Return under Section 139(4) for AY 2020-21 has been Extended to 31st May, 2021 ✓ Return filed in response to

Income Tax Return: File Belated ITR, Revised ITR Before Dec 31, I-T Dept Urges Taxpayers As Deadline Nears

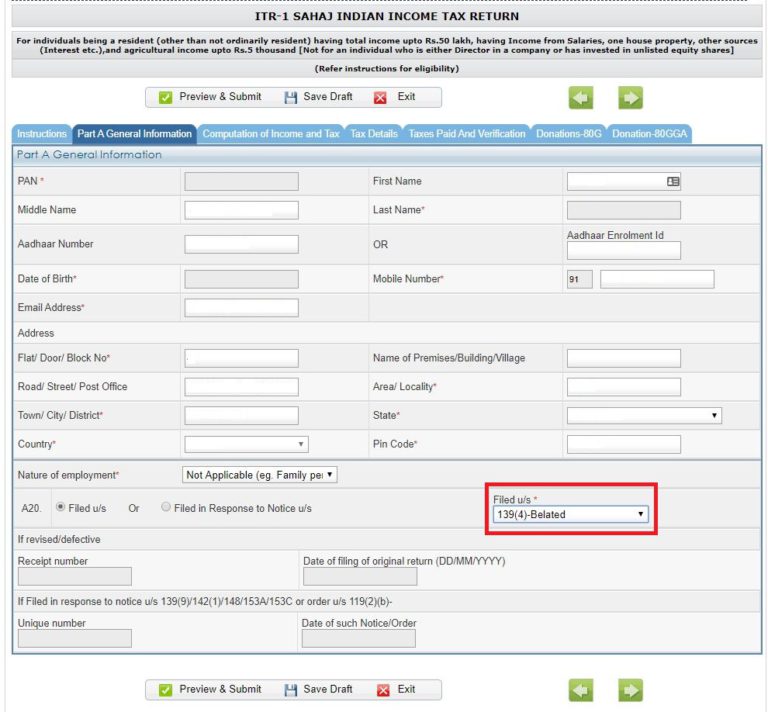

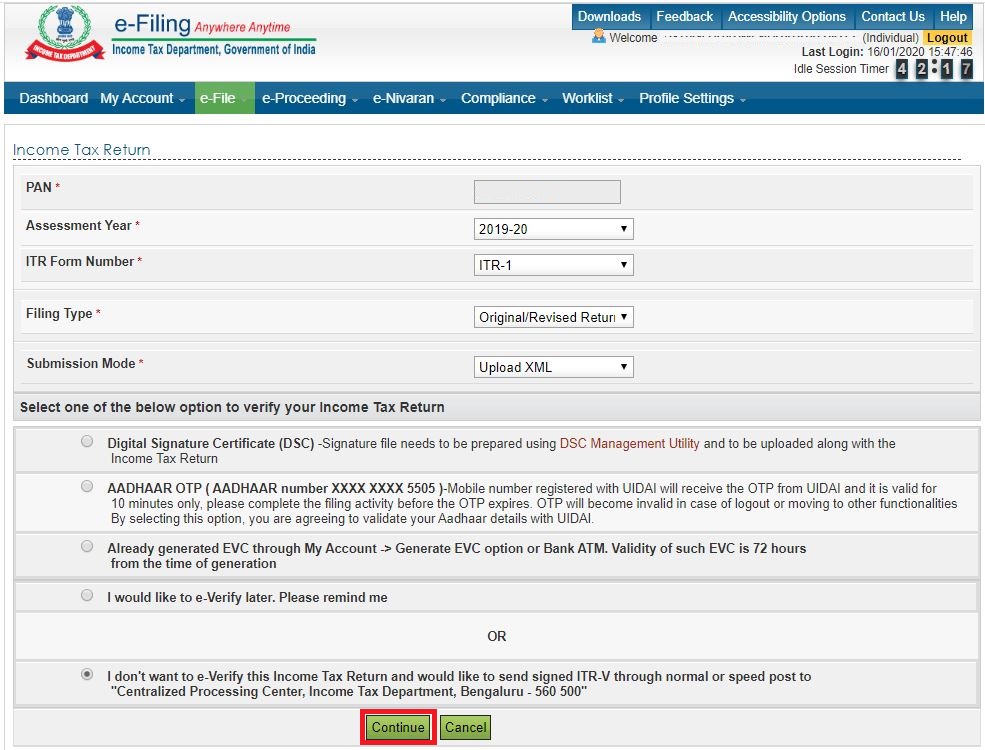

Filing of Belated Return under Section 139(4) of Income Tax Act - How to earn money through small savings

Can a Income Tax return be filed after the due date? | If I fail to furnish my Income Tax return within the due date, will I be fined or penalized?

Income Tax: Missing this crucial ITR filing step can land you minimum 3 years in jail | Personal Finance News, Times Now

ITR filing FY 2020-21: Who is exempted from paying late fee for filing tax return after missing December 31 deadline? | Personal Finance News | Zee News

Extension of Due date for filing of Income Tax Returns u/s.139(1) of Income Tax Act till 31st Aug 2022

![Return of Income ( Section 139, 140, 140A)[Graphical Table Presentation] Return of Income ( Section 139, 140, 140A)[Graphical Table Presentation]](https://incometaxmanagement.com/Images/Graphical-ITAX/Return%20of%20Income/5-Section%20139(4)%20Belated%20Return.jpg)

![Return of Income ( Section 139, 140, 140A)[Graphical Table Presentation] Return of Income ( Section 139, 140, 140A)[Graphical Table Presentation]](https://incometaxmanagement.com/Images/Graphical-ITAX/Return%20of%20Income/4-Section%20139(3)%20Loss%20return.jpg)